Merriam-Webster says one synonym for Seniors is “Betters.” Hmm, that sounds right, maybe not to our kids, but in a lot of cases, we do know better just by virtue of living longer and having more life experience, right? “Betters,” I like that. For those over 55 who own a home, with prices at an all-time high, (or anytime really), if it is time to make a move, this is valuable information to consider as part of your life and retirement planning.

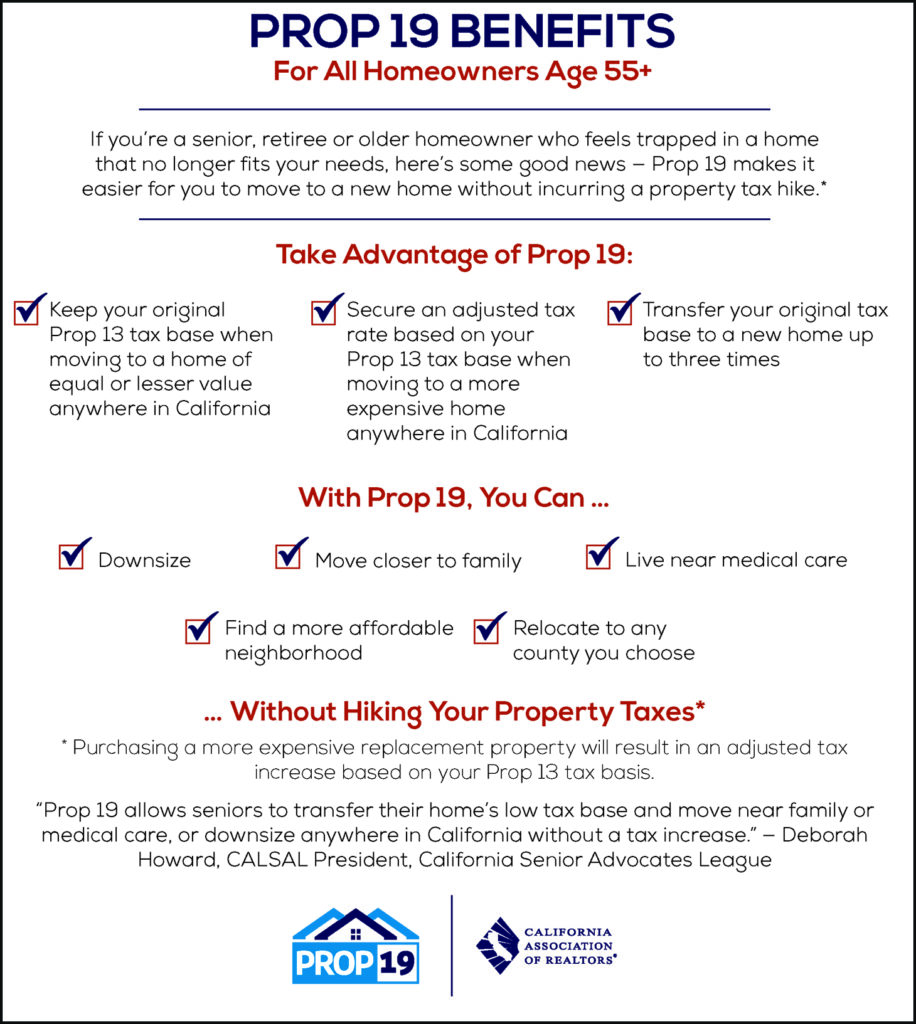

Proposition 19, which has passed and now in effect, contains significant benefits for those 55 and over regarding your tax base upon sale of a property. (See graphic.) There are similar benefits for the disabled and those displaced by natural disasters and/or wildfires.

With Prop 19 you can keep your original Prop 13 tax base when moving to a home of equal or lesser value or secure an adjusted tax rate based on your Prop 13 tax base when moving to a more expensive home in California and transfer your original tax base to a new home up to three times.

Now you can downsize, move closer to family or friends, be closer to medical services, find a more affordable neighborhood, relocate to ANY county you choose (vs only a county that reciprocates in the program as in the past). Perhaps you are in a 2-story home, want no stairs, or are tired of yard upkeep and want something smaller. Maybe you need home repairs and do not want the hassle, want to live in warmer climates, or in a retirement community. Part of our Senior Move Management Services are visiting some of those communities before you make a commitment.

Additionally, before you make a move, contact your CPA or financial advisor or attorney and review the IRS website publication to see if there will be tax ramifications on which you had not planned. Study the Capital Gains Exemption with its’ rules and exceptions found in Section 121 of the Internal Revenue Code.

https://www.irs.gov/publications/p523

This Home Sale Gain Exclusion lets you exclude (i.e., not pay tax on) up to $250,000 of gain on the sale of your primary residence if you are single, or $500,000 of gain on the sale of your primary residence if you are married filing jointly with your spouse. You must have owned and lived there for two out of the last five years ending on the date of the sale of the home. You can only take advantage of this exclusion once every two years.

So, if you plan to sell two primary residences in the near future, it would be wise to use the exclusion on the one that will result in the most gain or sell one and move into the other for two years before selling it. Planning is key.